Get Effective Results from

Open Banking

API Management

The concept of Open Banking has first entered our lives with regulations of the European Union’s PSD (Payment Services Directive) dated 2007 and MiFID II (Markets in Financial Instruments Directives II) dated 2014.

What is Open Banking?

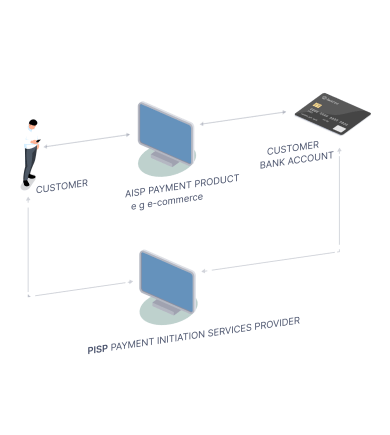

Infrastructure Consists Of Two Main Components;

AISP (Account Information Services)

PISP (Payment Initiation Services)

Digital Banking and Information Systems Requirements

Relationship Networks In Traditional And Open Banking

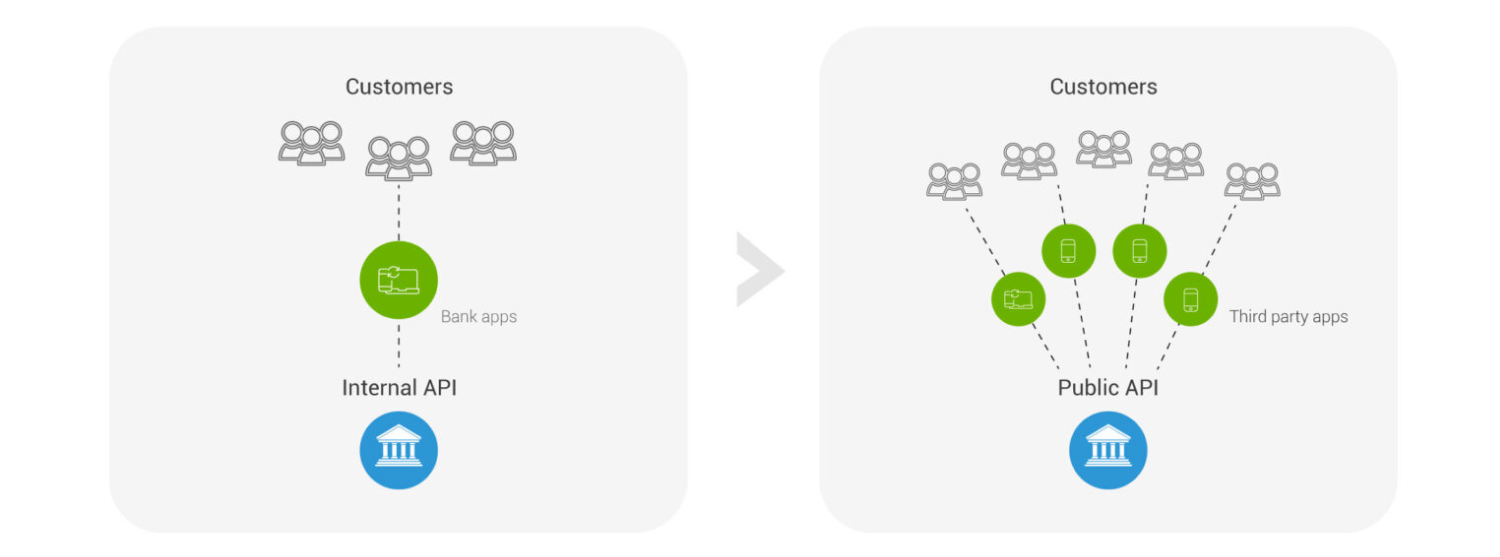

How Should Banks Handle API Usage?

One of the most important regulations developed with PSD2 in the Eurpopean Union is to make data sharing mandatory within the scope open banking

Open Banking API Management

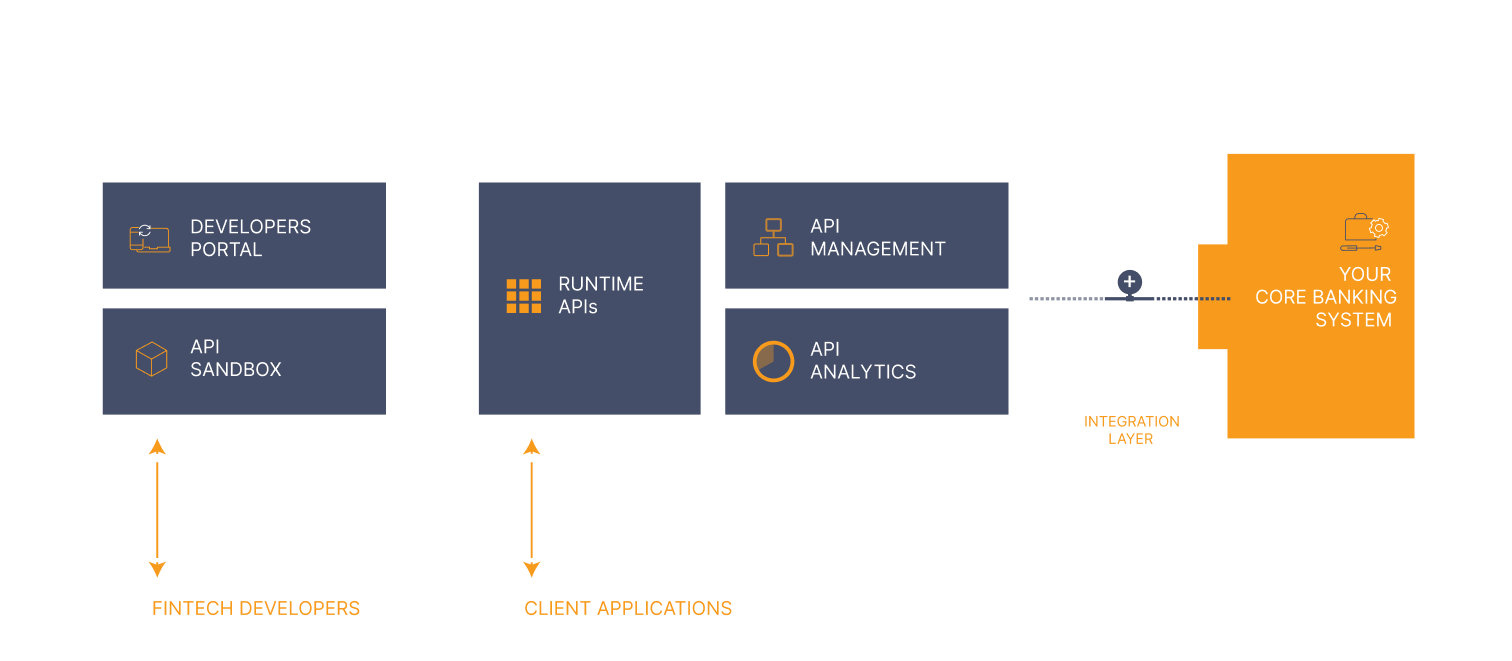

It is specially produced for the Financial institutions of the Open Banking era.

Financial Institution Environment

aplonAPI

The Need to Alter to an API-Based Business Model

Together with our solution partner PaymentComponents, we are among the first to realize the benefits and true potential of open banking. We have learned a lot by working with leading financial institutions around the world. In order to benefit from this historical transformation, we have grasped the challenges and opportunities faced by those operating in the sector.

Based on this, an award-winning product named aplonAPI was developed by our solution partner PaymentComponents, which represents the best solution available today for financial institutions willing to stay at the top of the competition. With AplonAPI, you will be able to offer Service Model Banking / Platform (BaaS / BaaP) solutions to your customers and earn money from your APIs in the simplest and fastest way possible. The best part is, you’ll get a ready-to-use API sandbox with a FinTech ecosystem of AISPs and PISPs to modernize your payment system quickly so you can generate value from day one.

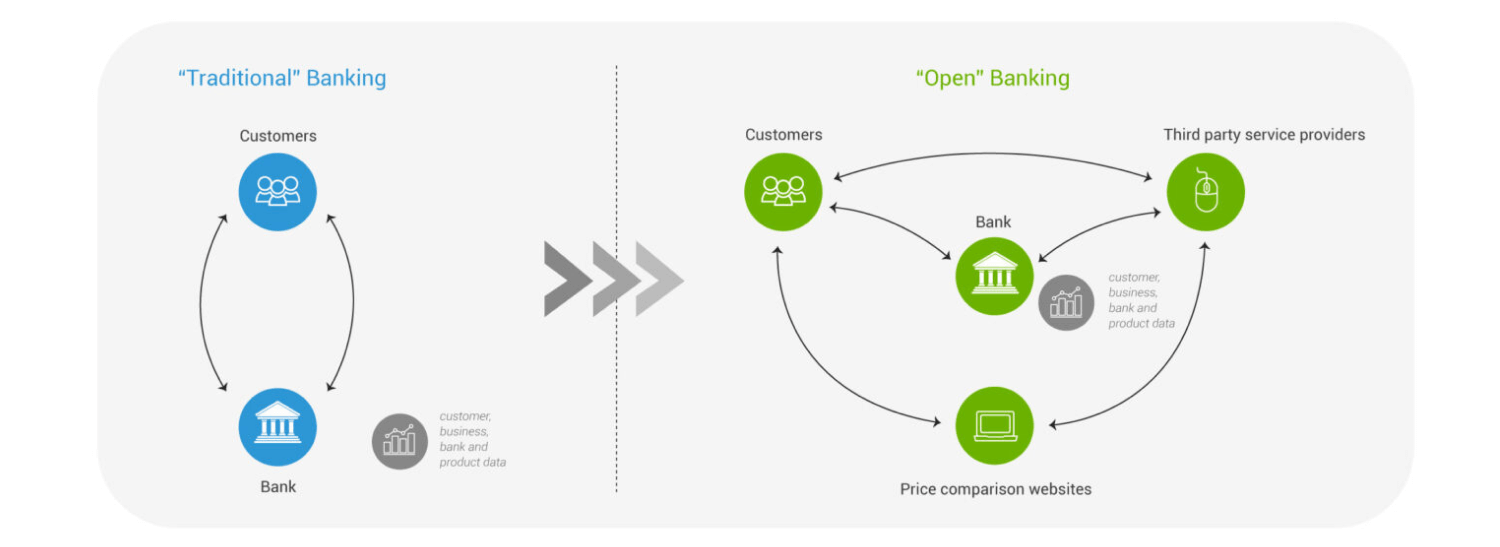

Traditional and Open Banking

There are three main subjects in the open banking model. These are “customer” using open banking service, “payment service provider” with which the customer has a payment account, and “third party providers” with whom the customer’s data is shared.

Contact Us Today

Contact us today to learn how we can help you with efficient Open Banking API Management.